Corax Cyber 360

Corax Cyber 360 is enterprise level cyber risk management/optimization framework.

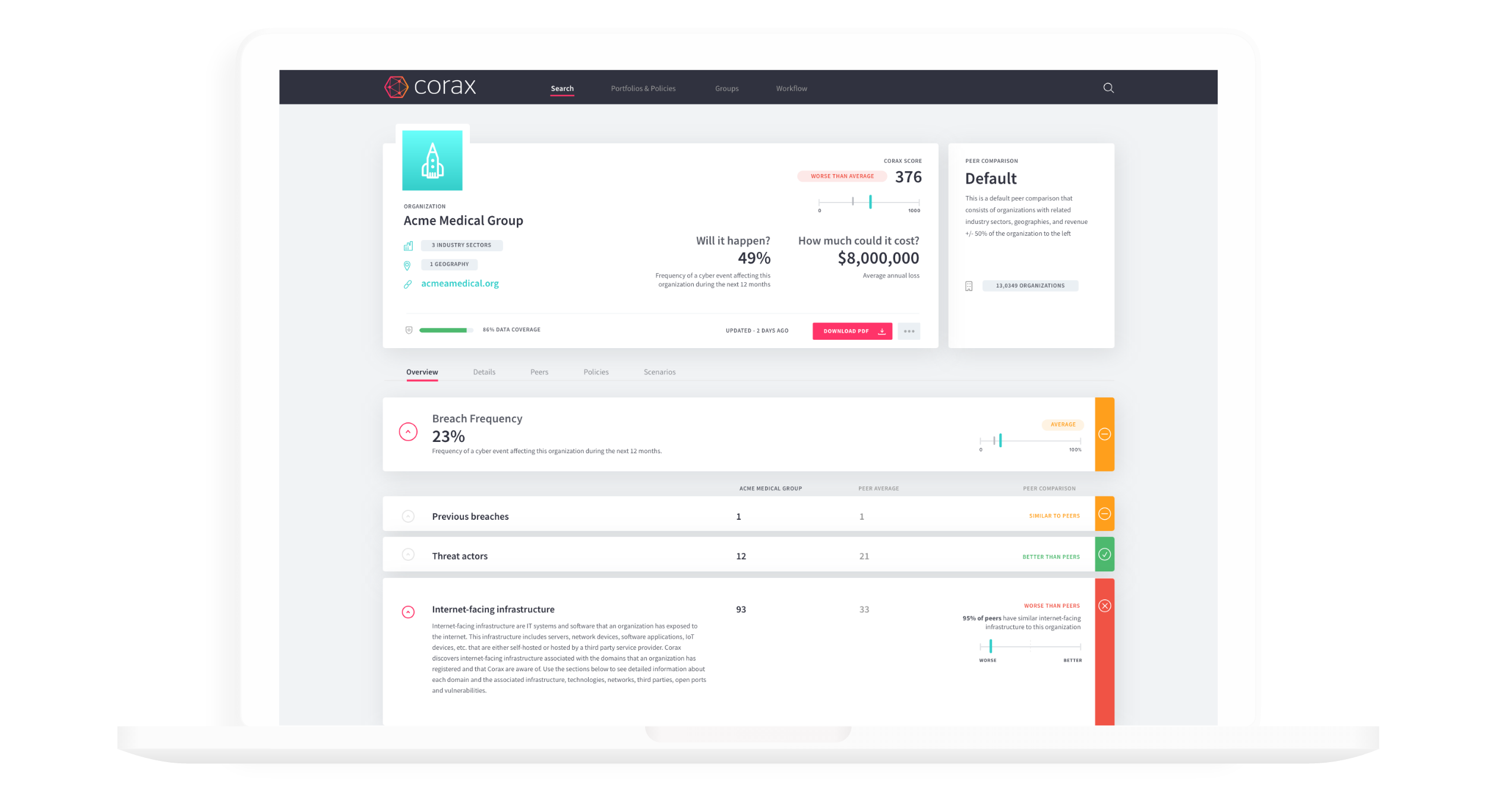

Ai based cyber risk data and analytics.

We leverage our proprietary data on the security and technology resilience of more than 10 million interconnected companies to provide faster and more accurate benchmarking, predictions and expected loss costs of cyber events.

With each day, our database grows by over 100,000 companies to build the world’s most comprehensive modelled view on cyber risk.

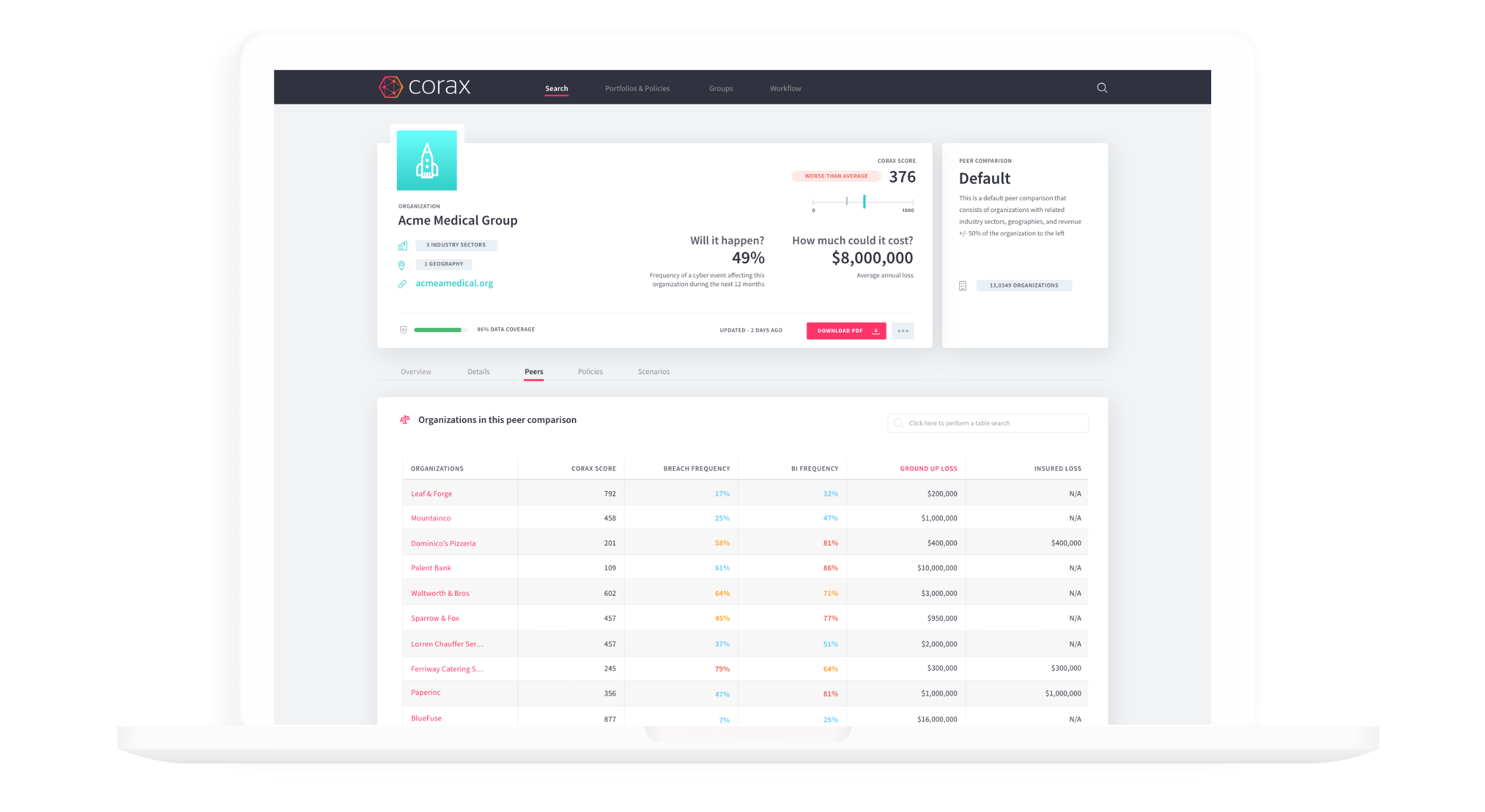

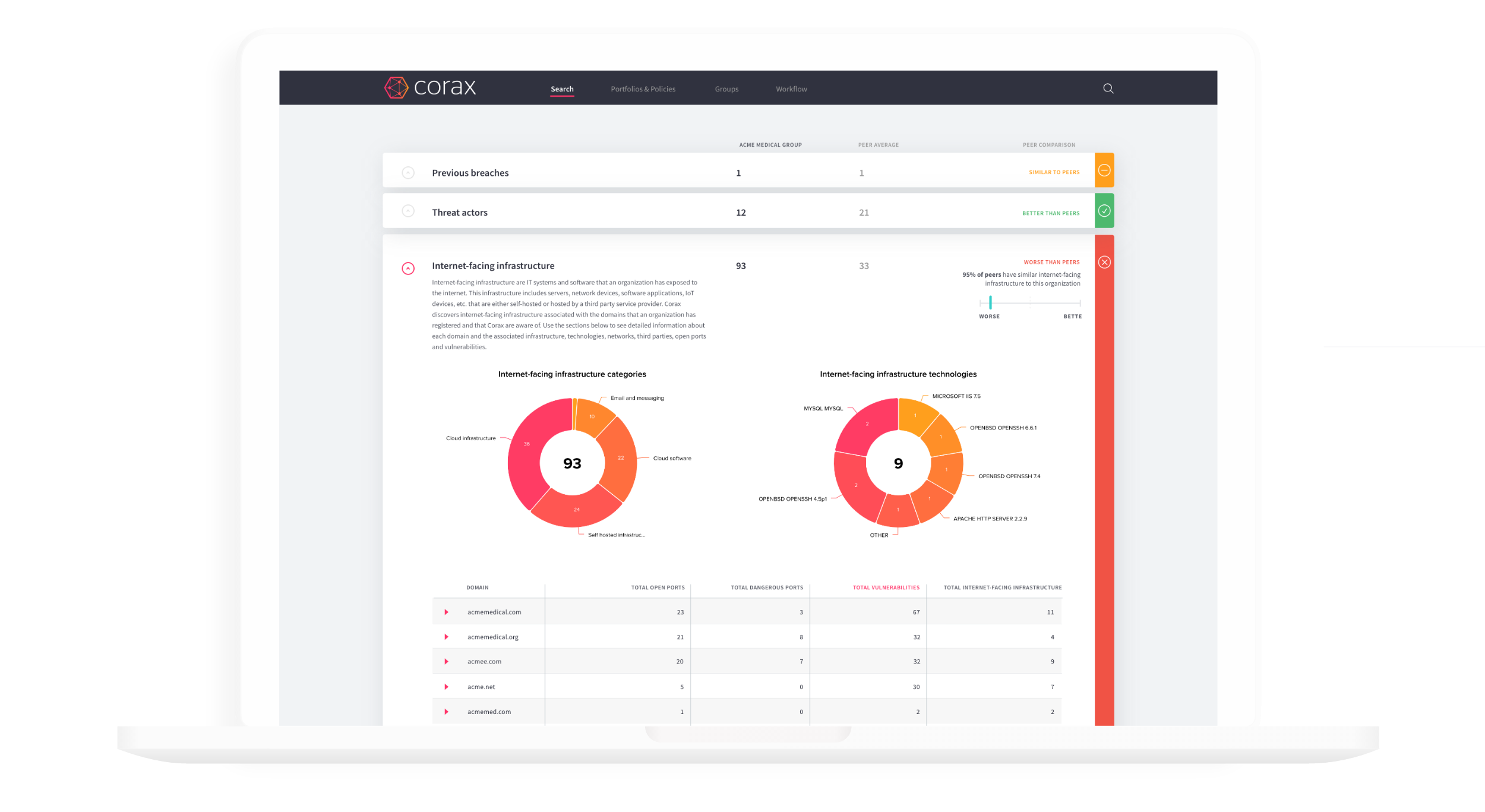

Our platform not only enables you to see how you compare in your industry against your peers, but also provides a customizable peer group.

At rapid speed, we can look across a single company and at group level, giving you informed data metrics to gain the confidence to dig deeper into each risk.

Born in the insurance industry, we help some of the world’s largest insurers identify risk levels and financial impact across different industry sectors and business types.

Auditing, compliance and vCISO services

Corax Cyber Pro is a cyber security consulting service. We leverage our proprietary data with our professional insight to help companies access top cybersecurity skills.

Bussinesses that use Corax Cyber platform can identify and quantify current and future clients the potential financial impact of the cyber event. Corax Cyber 360 does the heavy lifting for the customer and offers access to sophisticated cyber risk that contains:

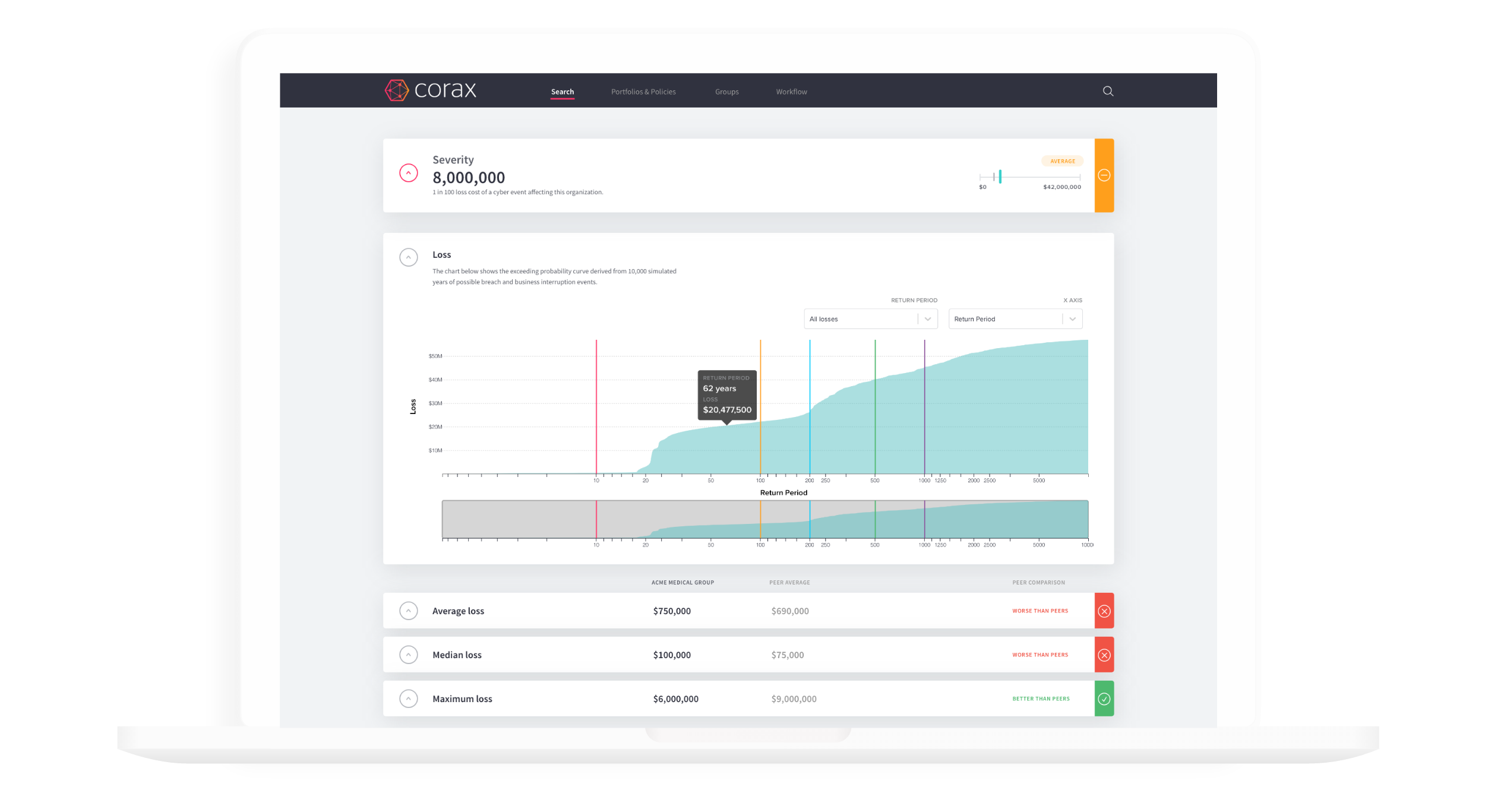

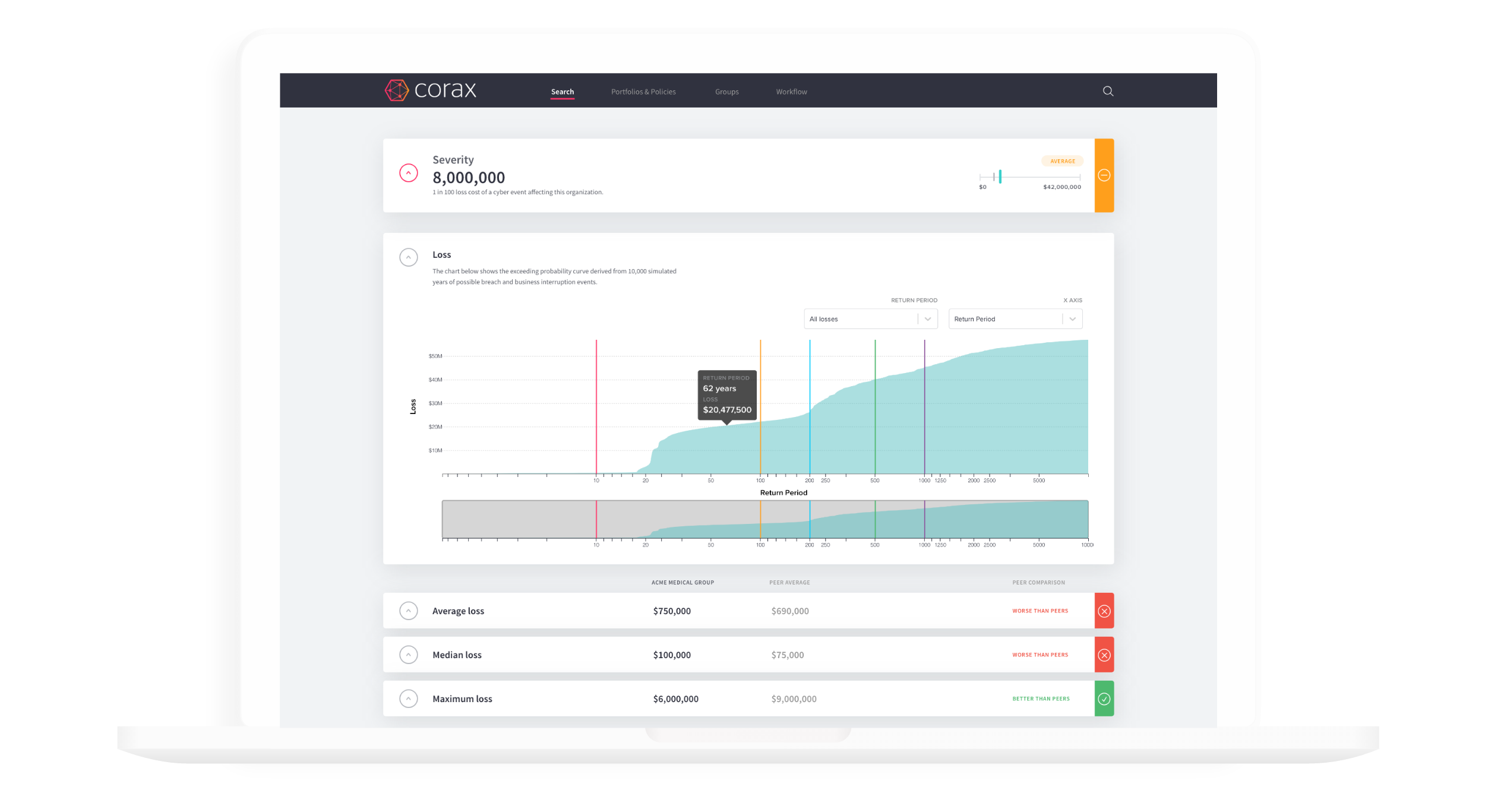

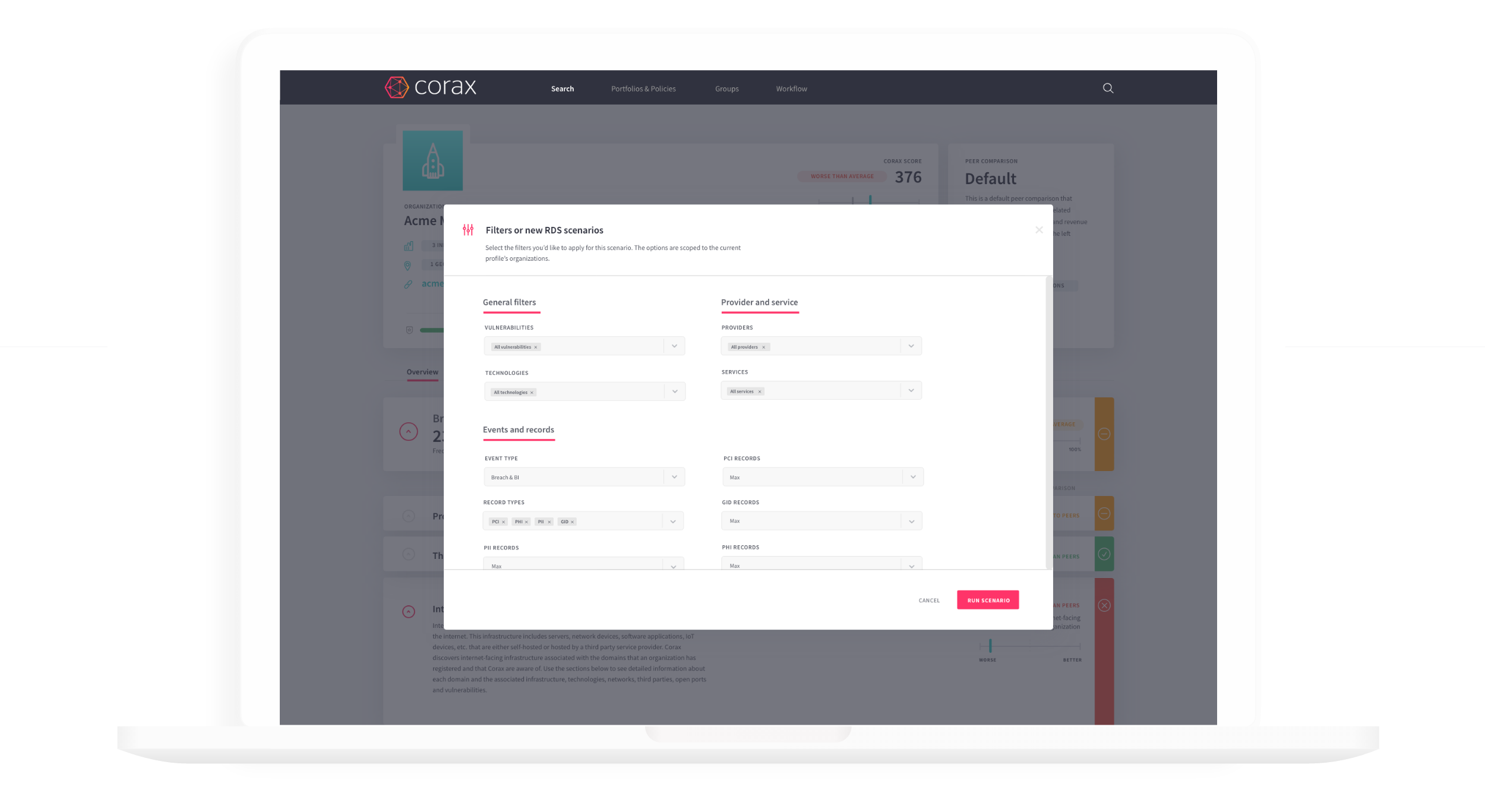

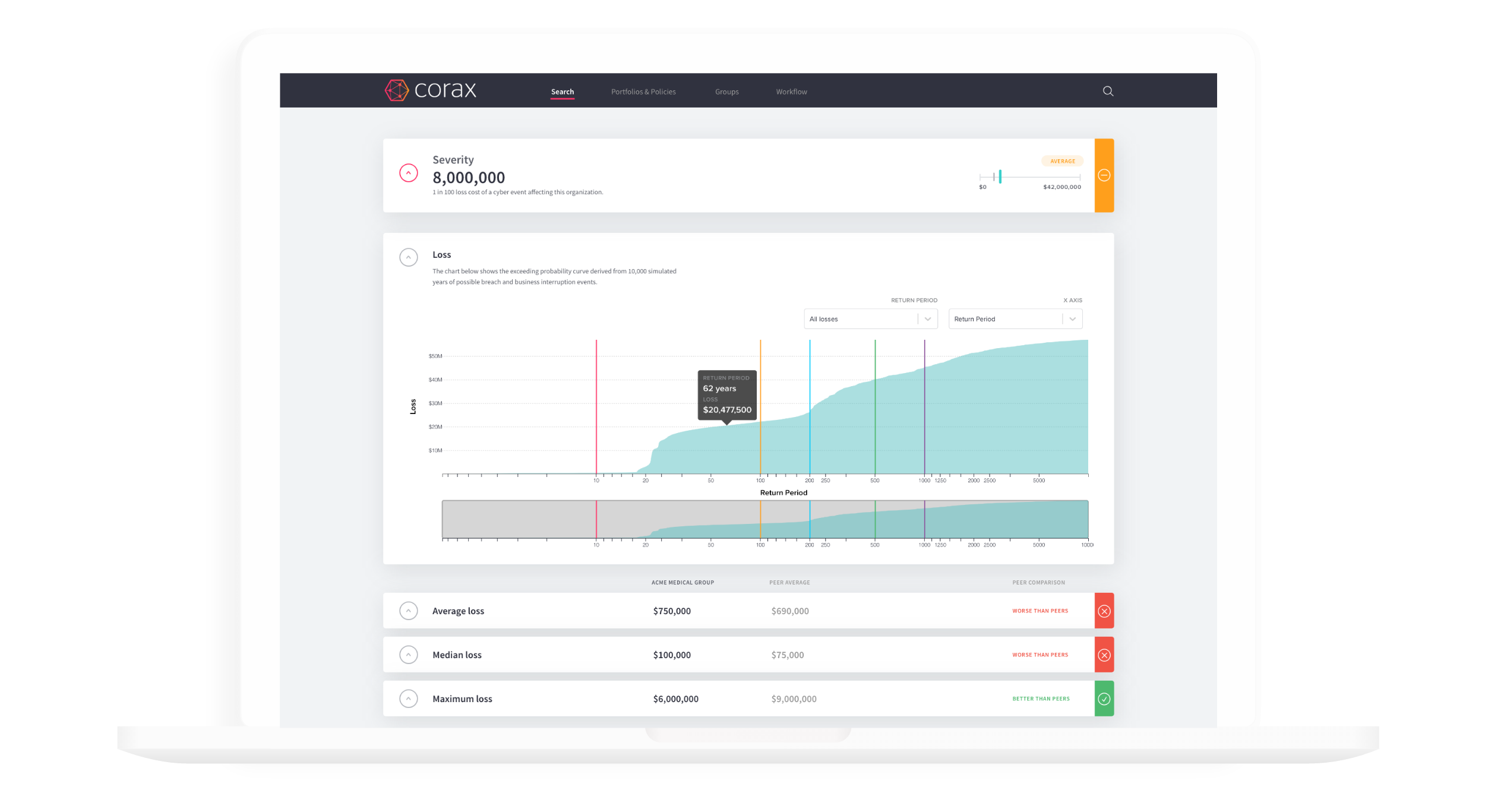

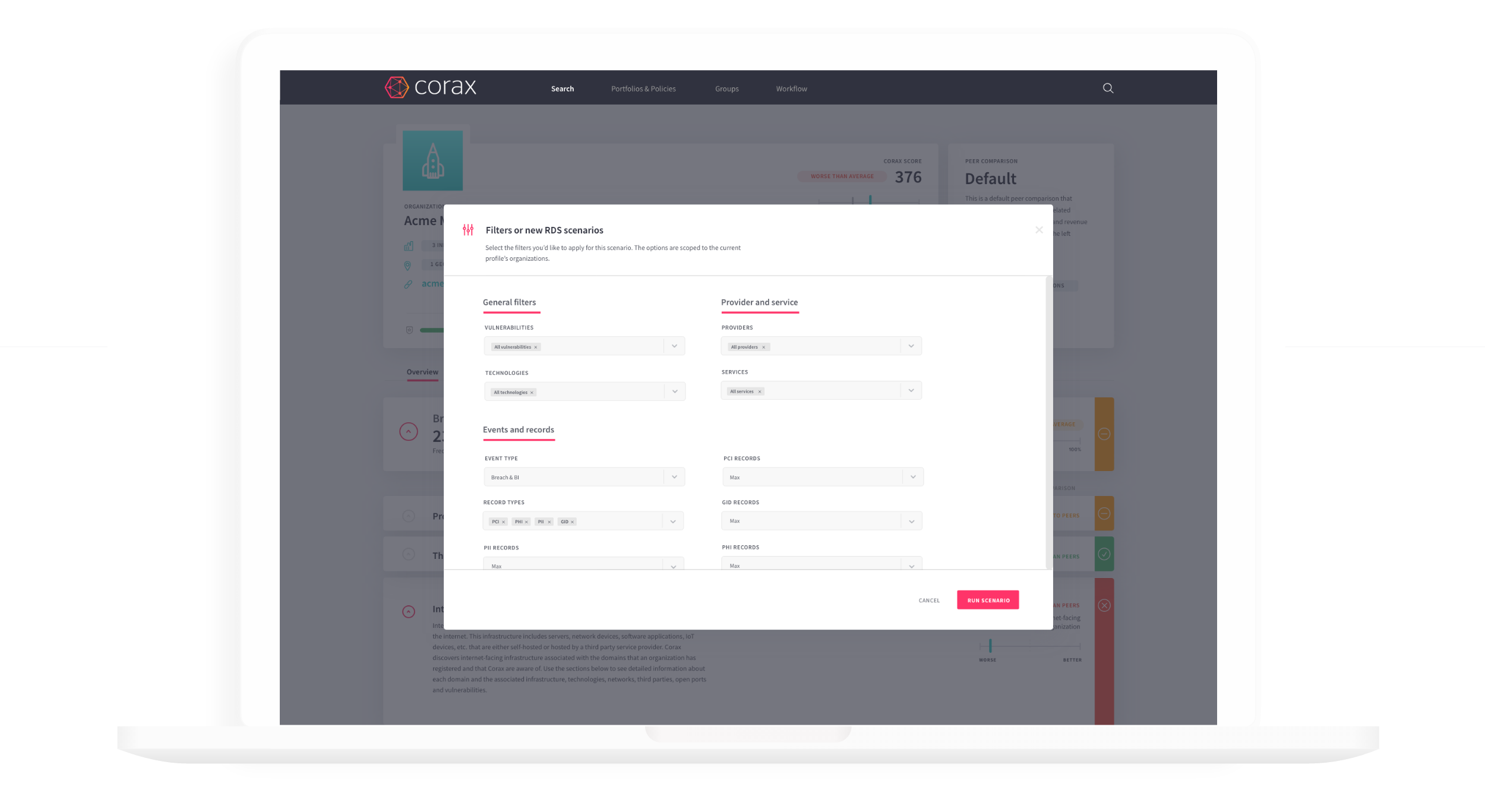

With individual risk ultimately changing inputs at the portfolio level, Corax produces individual Exceedance Probability loss curves intrinsically tied to entire portfolios. EP curves are created through the generation of individual events which can be viewed separately, as well as user-created events.

Make informed decisions. Use advanced risk analytics to create the right cyber insurance packages, at the right premiums. Calculate the likely premium required to meet a specific profit margin. Corax explains the underlying risk associated with the policy, and how to mitigate this with different deductibles, limits and attachment points.

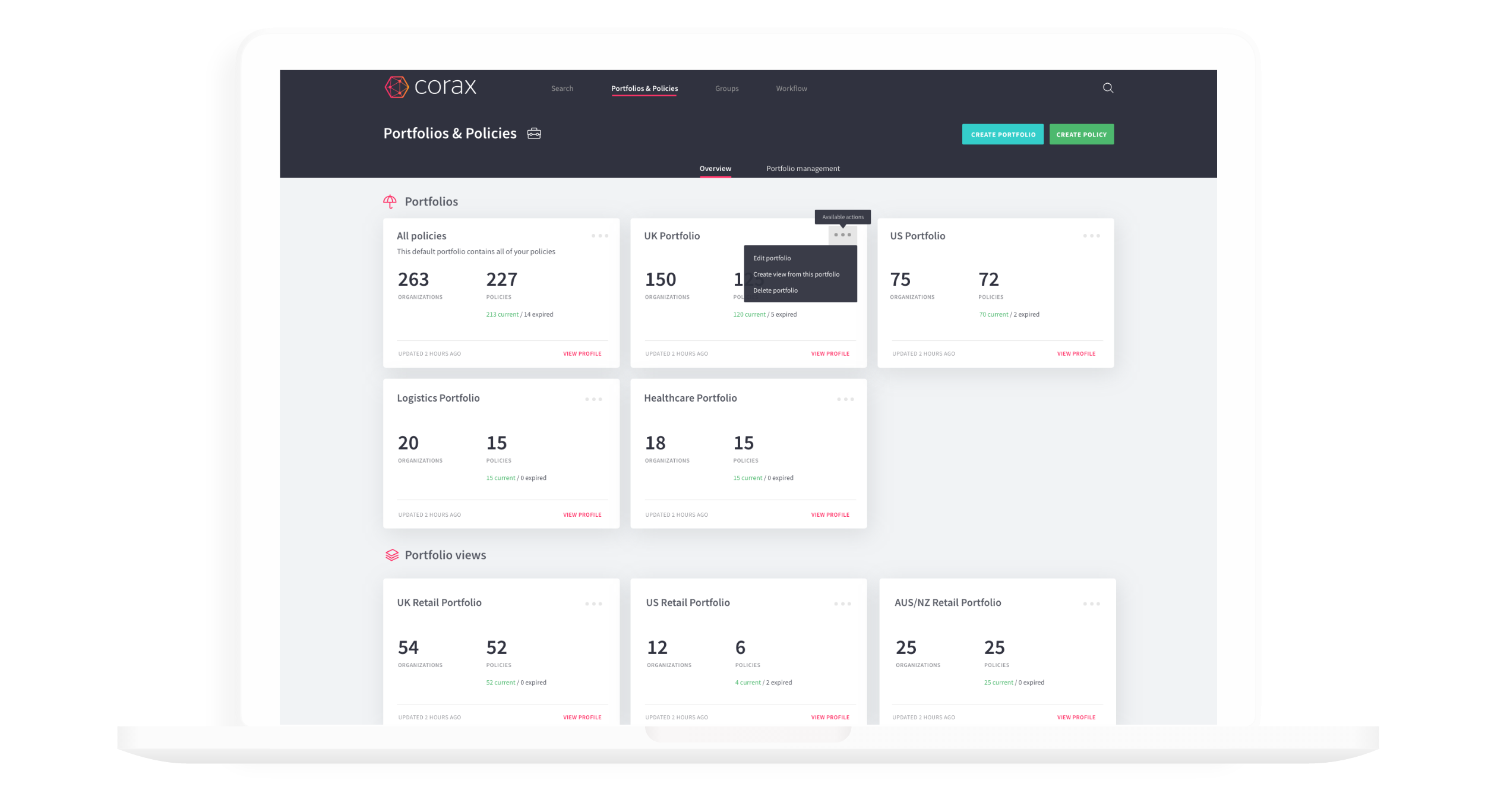

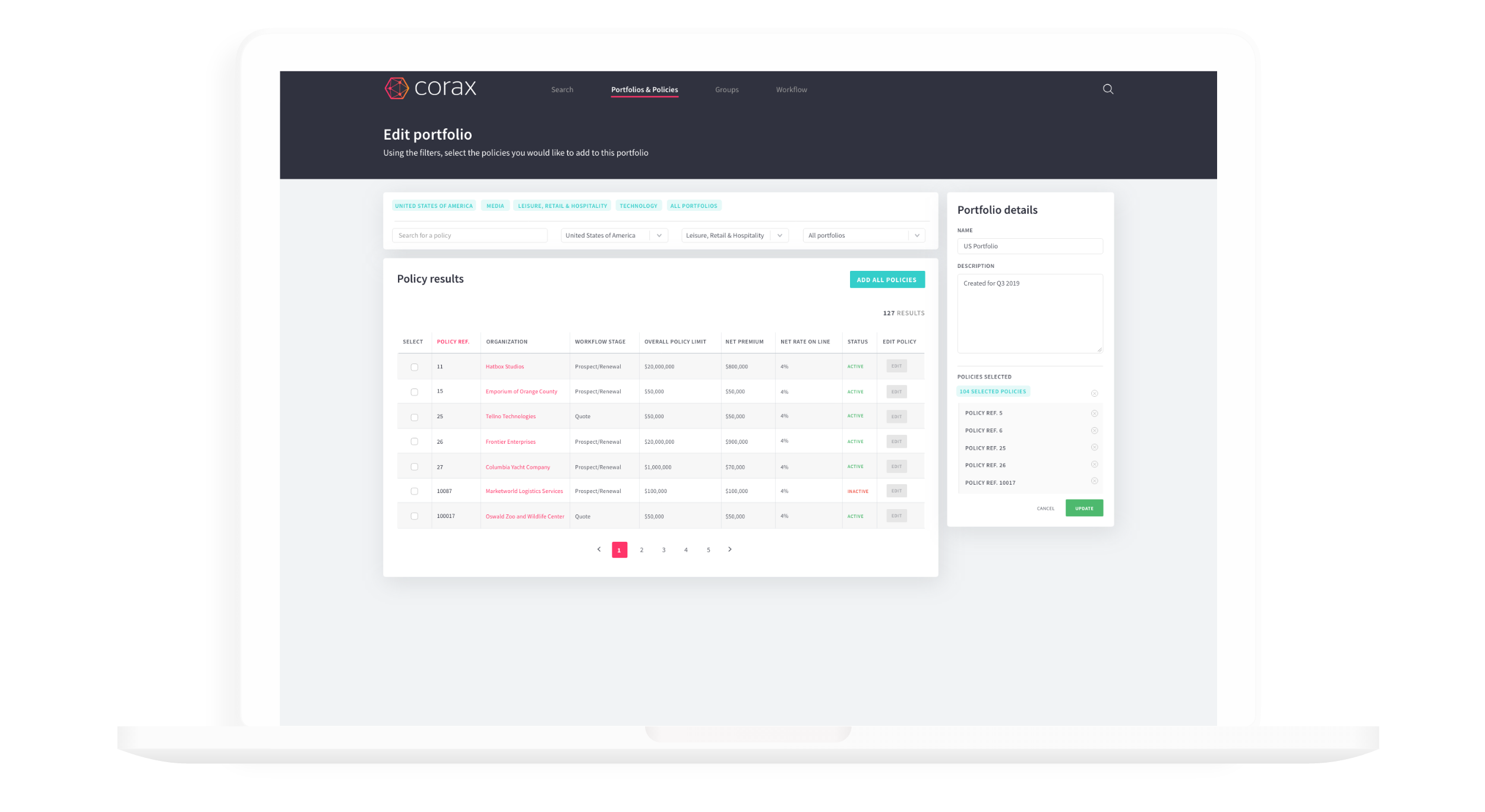

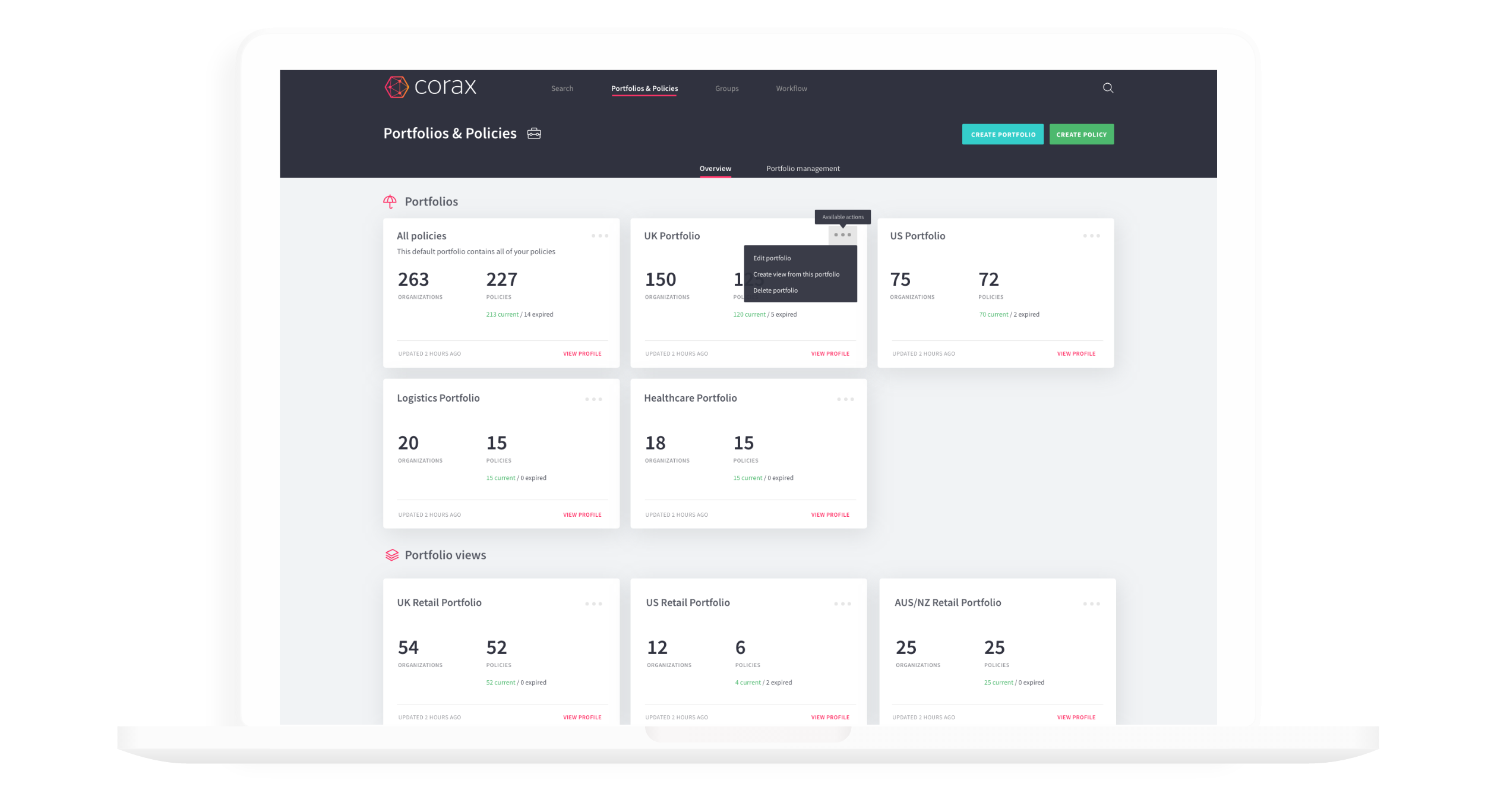

Manage portfolio risk based on real data – see the marginal impact of a new risk to your portfolio, segment your portfolio by risk types, and analyze upcoming renewals within the context of your overall book of business.

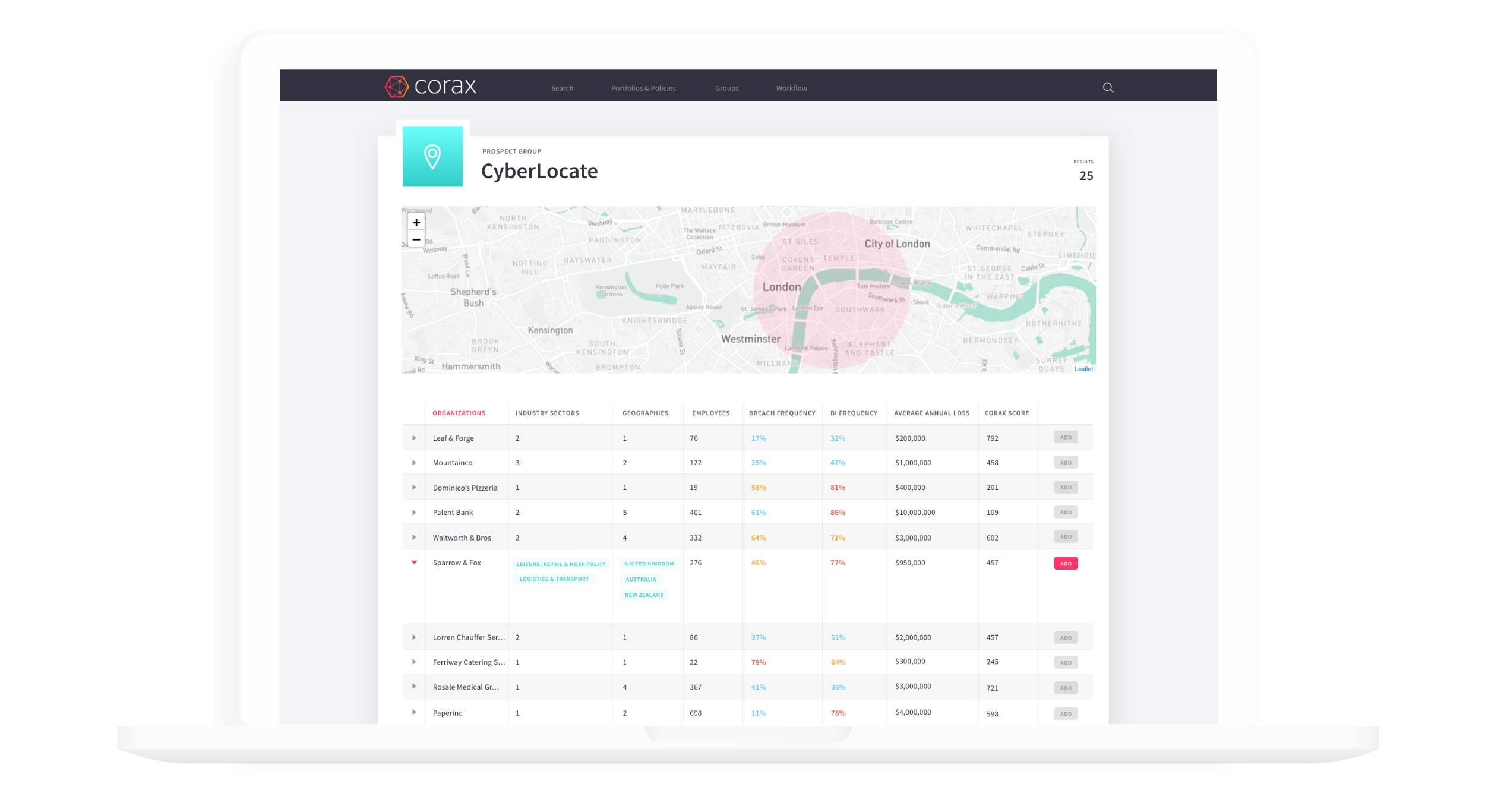

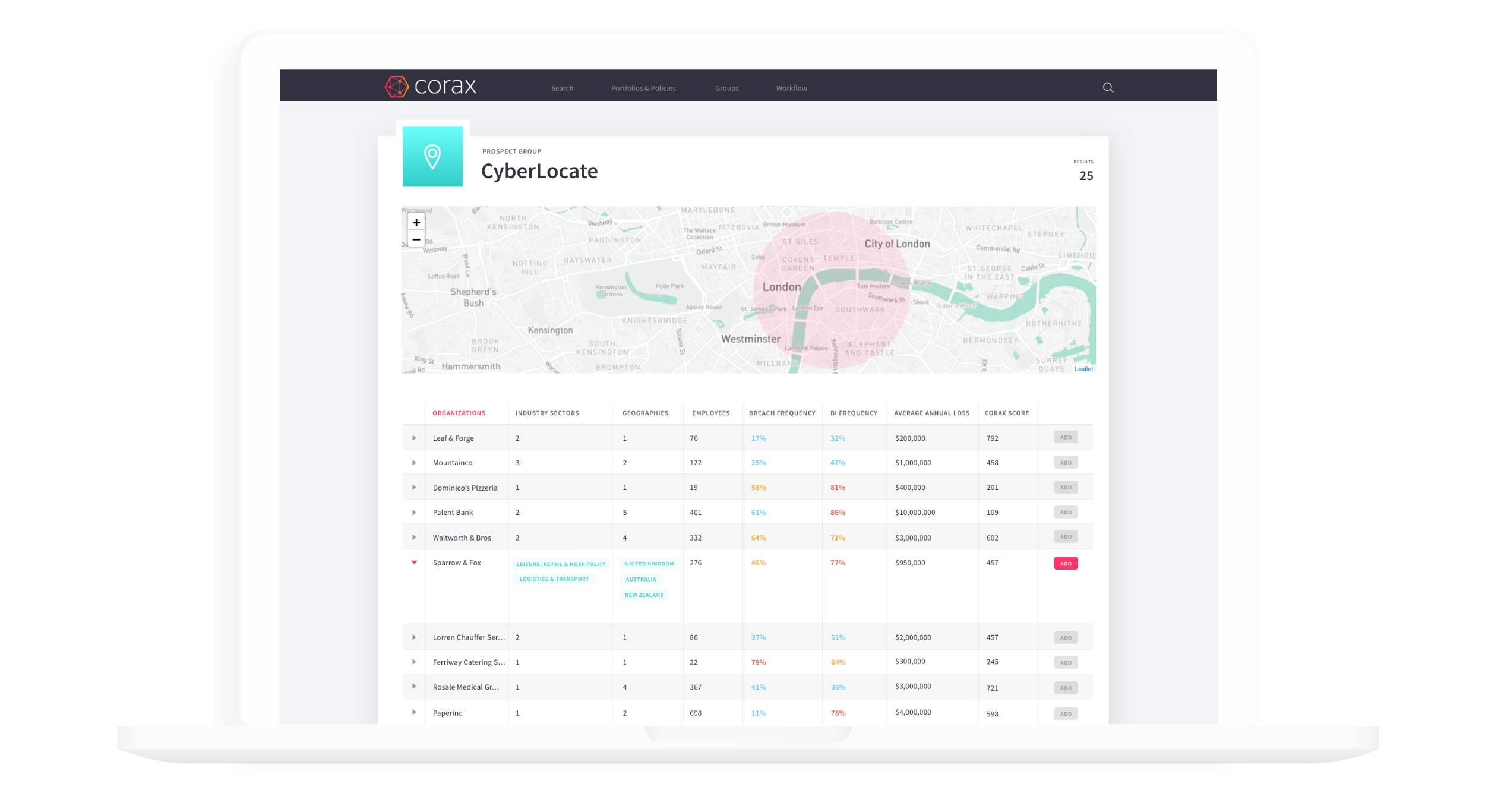

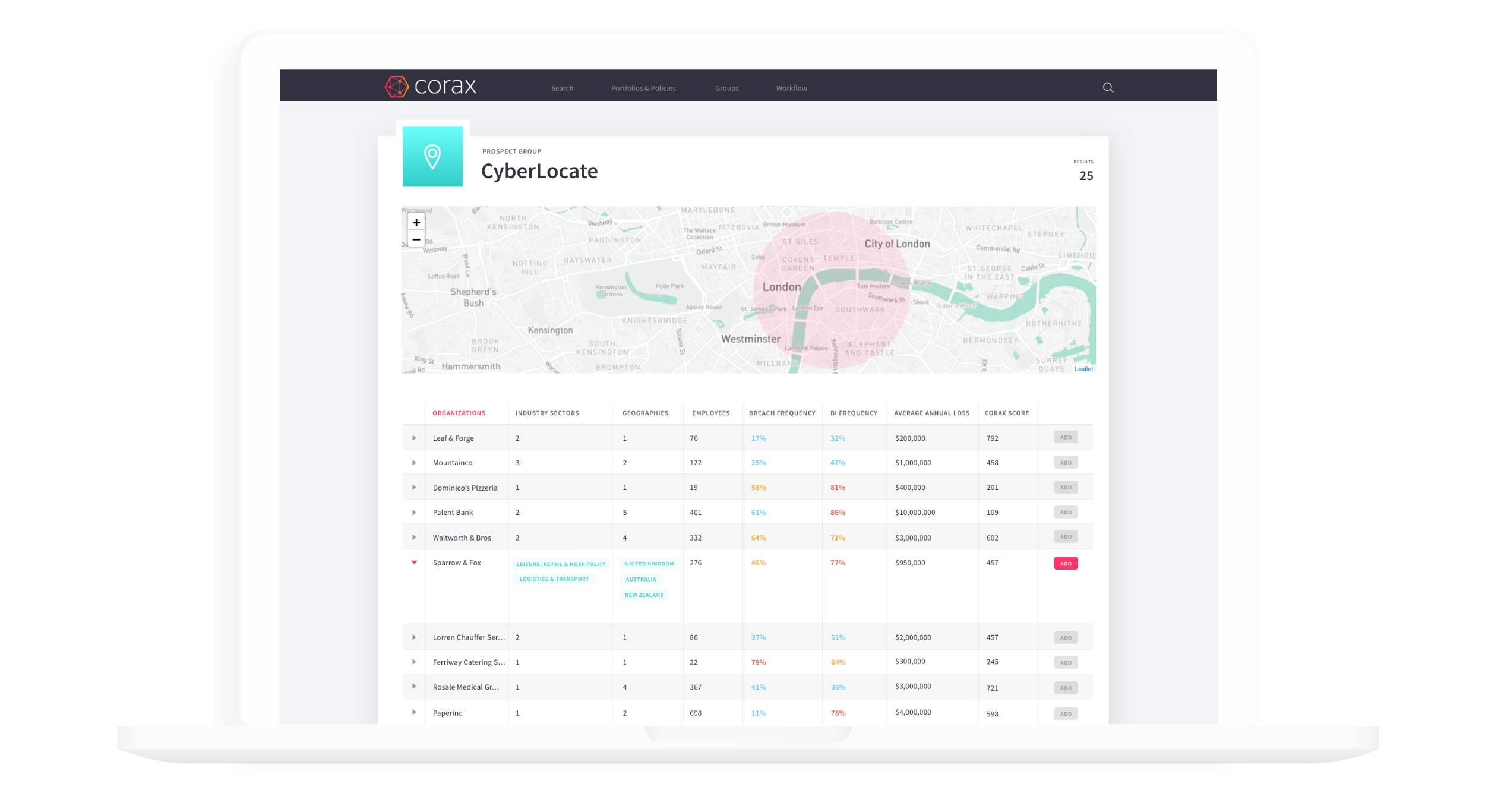

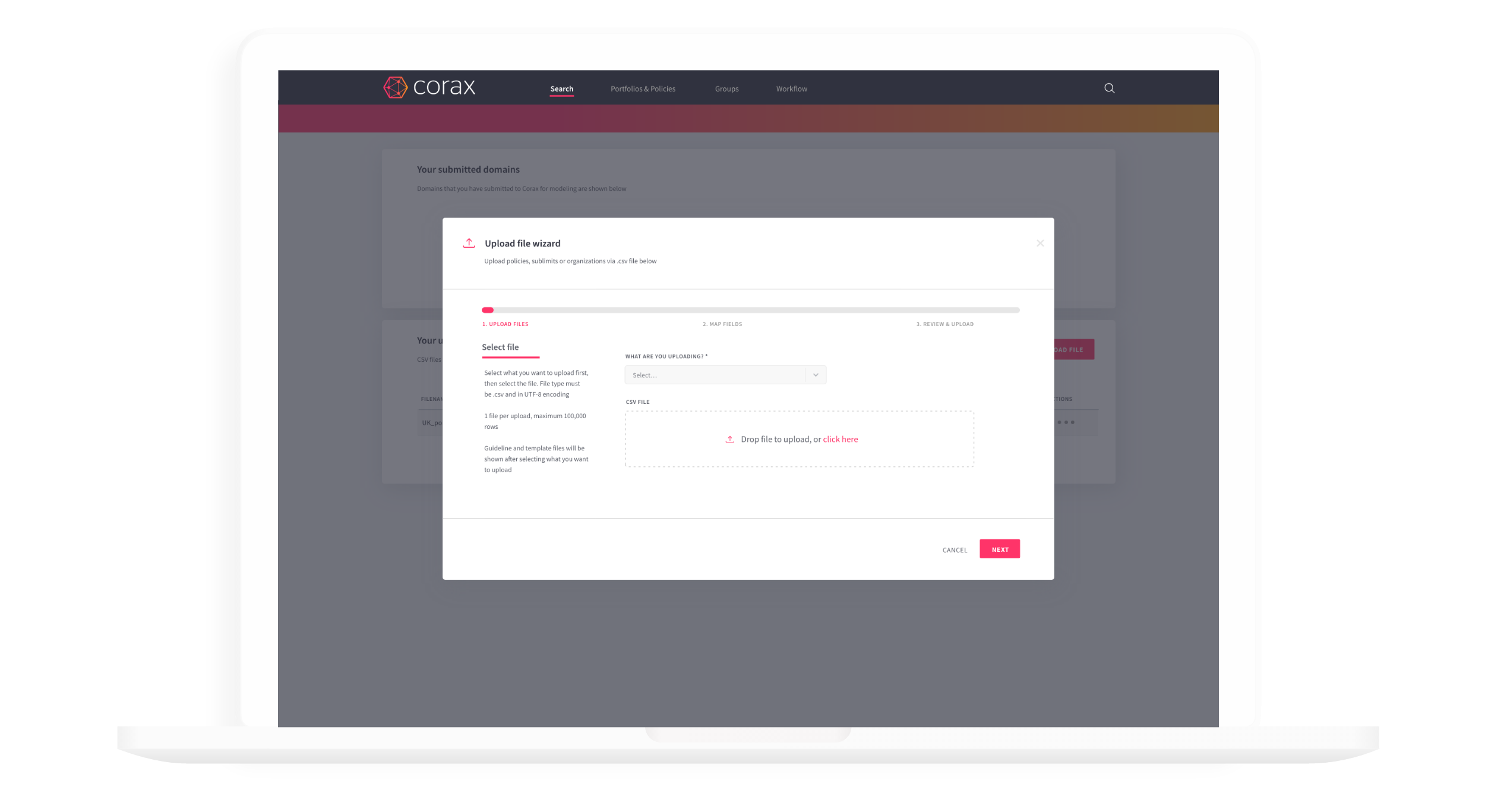

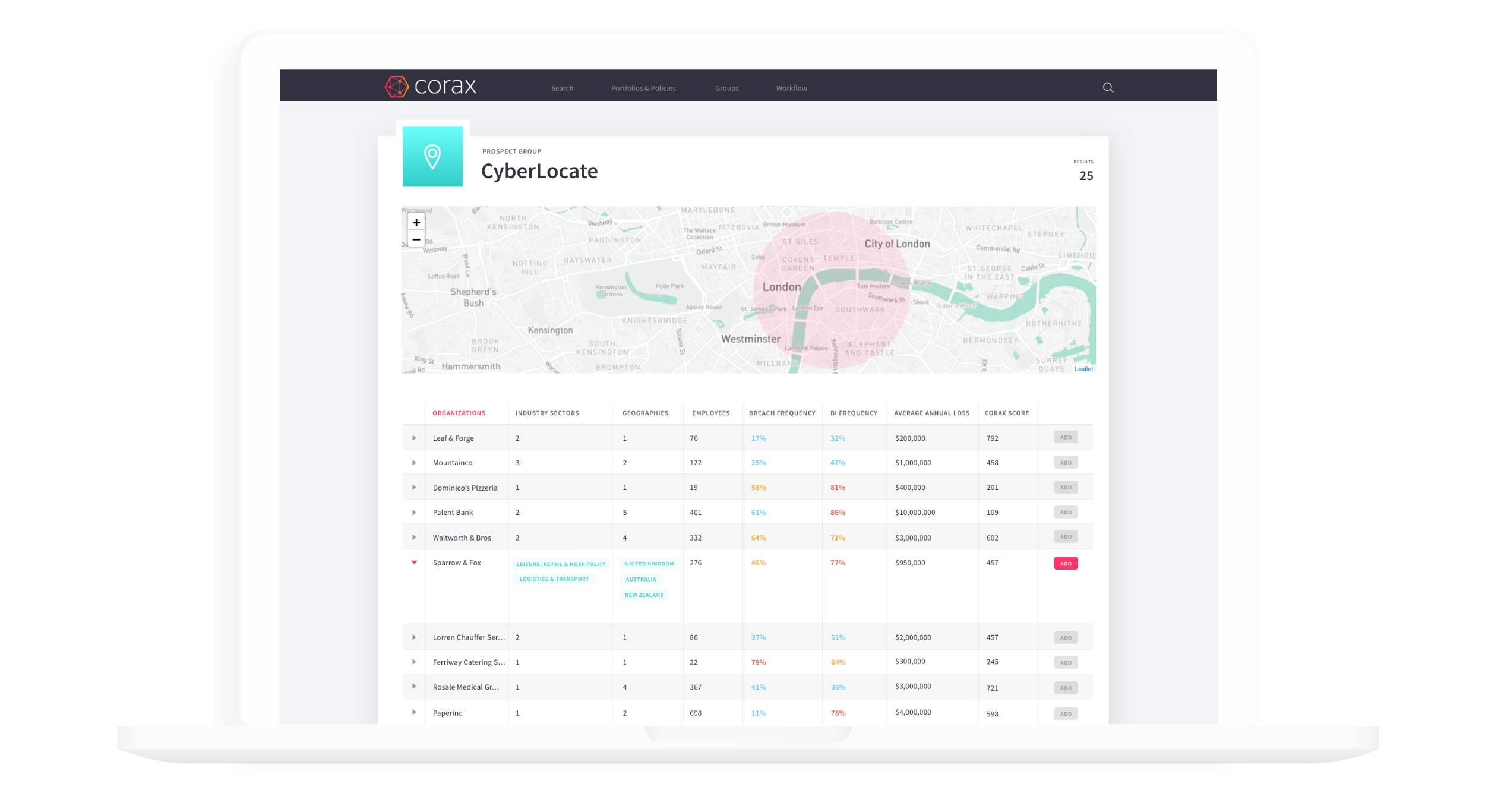

Cross-sell cyber to your existing clients via bulk upload of lists of clients or via API integration of your existing systems. Identify new potential clients using Corax’s cutting edge CyberLocate tool to set geographic search areas.

Customized Cyber Security/ Resilience Solutions (CCS)

CCS is triple layered, custom-tailored cyber-security solution, based on risk informed decisions on the actions and investment needed to minimize the impact of cyber risk on your business.

Layer 1 – Technical controls

Layer 2 – Cyber Insurance

Layer 3 – Business continuity

Layer 1 consists of custom tailored plan to adjust and fortify your existing IT infrastructure.

Cyber Insurance allow to transfer certain risks to third party. Our options include: Traditional Commercial Cyber Insurance, Captive Cyber Insurance, and Adaptive & Dynamic Cyber Insurance.

Business Continuity Plan consists of custom tailored processes and procedures that ensures that business will continue even during disaster.

Advanced monitoring system for governmental organizations

Customized Cyber Security/ Resilience Monitoring Solutions.

Solution: data & reports on all companies within specific region, industry or organization portfolio worldwide.

Corax’s financial model is aligned with traditional insurance DFA models, enabling users to input complex structures on an individual or group basis.

Corax has modeled and monitored millions of detailed company risk profiles. This industry view of risk can be analyzed top down to enable users to segment risk and understand the correlation of loss on an industry basis. Users can also utilize this industry view to develop an expected loss from silent cyber profiles.

Corax’s proprietary data discovery and aggregation of third party sources enhances the level of data and insight available at reinsurance level.

Corax’s model produces a YELT output, enabling users to see all scenarios that make up the whole EP curve, which includes historical events. These individual events can be monitored as an alternative aggregate approach, which can also be utilized through user-created events.

Get started with Corax

Explore our pricing options and find out which plan works best for your business.